Introduction

Corporate governance and ESG (Environmental, Social, and

Governance) are two closely related concepts. Corporate governance refers to

the system of rules, practices, and processes by which a company is directed

and controlled. It encompasses the relationships between a company's

management, its board of directors, shareholders, and other stakeholders, and

the goals for which the corporation is governed. Good corporate governance is

important for ensuring that a company is managed in an ethical, transparent,

and effective manner and that it maximizes value for all stakeholders over the

long term.

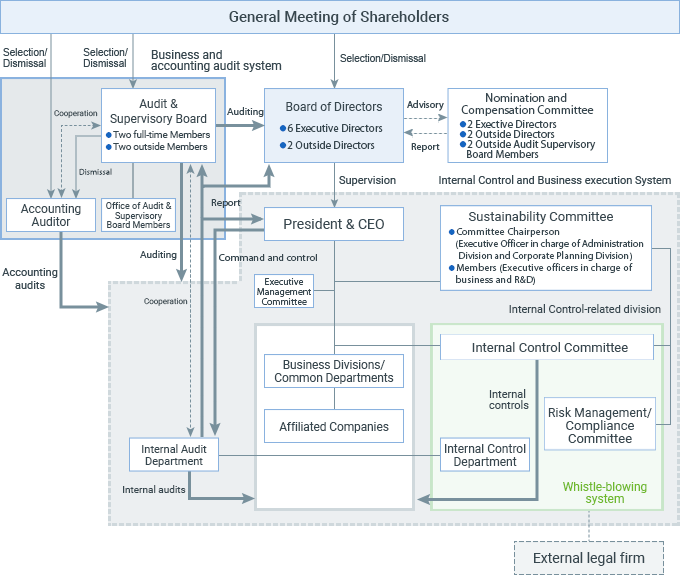

Corporate Governance Framework

ESG, on the other hand, refers to the three key factors

that are used to measure the sustainability and ethical impact of an investment

in a company: Environmental, Social, and Governance. Environmental factors

include a company's impact on the environment, such as its carbon footprint and

resource use. Social factors include a company's impact on society, such as its

treatment of employees, customers, and suppliers. Governance factors include a

company's management structure, executive compensation, and board composition.

ESG is becoming an increasingly important consideration

for investors and stakeholders, as they seek to invest in companies that are

aligned with their values and have a positive impact on the world. Good

corporate governance is a key component of ESG, as it ensures that a company is

managed responsibly and sustainably, and that it is held accountable for its

environmental and social impact. Companies that prioritize ESG factors are more

likely to attract and retain investors, customers, and employees and are better

positioned to create long-term value for all stakeholders.

Contemporary Corporate Governance

Corporate governance is evolving to take into account

changing business models, technological advancements, and stakeholder

expectations. Here are some key trends in corporate governance:

1. Emphasis on sustainability: Companies are

increasingly expected to integrate ESG considerations into their

decision-making processes and to report on their sustainability efforts. This

requires a shift in focus from short-term profits to long-term value creation.

2. Board diversity: There is a growing recognition

of the importance of board diversity in ensuring effective corporate

governance. Companies are expected to have boards that reflect the diversity of

their stakeholders and that bring a range of perspectives and skills to the

table.

3. Increased stakeholder engagement: Companies are

expected to engage with a wider range of stakeholders, including employees,

customers, suppliers, and communities. This requires a more inclusive and

collaborative approach to decision-making.

4. Technology and innovation: Technology is

transforming the way companies operate, and corporate governance needs to

evolve to keep pace. Boards need to have the skills and expertise to understand

and oversee technological risks and opportunities.

5. Transparency and accountability: There is a growing

expectation for companies to be transparent about their governance practices,

including executive compensation, board composition, and decision-making

processes. Companies are also expected to be accountable for their actions and

to have effective systems in place for managing risk.

Overall, corporate governance in the new era is focused on

creating long-term value for all stakeholders, rather than just maximizing

short-term profits. It requires a more inclusive, collaborative, and

transparent approach to decision-making, and a willingness to adapt to changing

circumstances and stakeholder expectations. These points bring sustainability

to the forefront, but from the perspective of stakeholders. It is increasingly

becoming impossible to focus on shareholders only and it is not sustainable.

This is where the concept of ESG is taking centre stage and the present boards

must have this on their agenda.

Corporate Governance System incorporating ESG

The

Nexus Between Profits and Principles

Corporate Governance and ESG represent what Johnson

Lambert referred to as ‘the intersection between profits and principles”. The

awareness in the recent past on the ESG issues has driven companies to review

their system of values and ensure that they reflect evolving stakeholder

priorities, especially on climate change and social justice. ESG reflects a

shift in how companies evaluate the risks that could impact their organisation

and how they are evaluated by their stakeholders on how they respond to environmental

and social issues.

Companies that proactively embrace ESG may be better

positioned in the market. While ESG is deemed a cost, it is increasingly

becoming a profit too. Investors and business partners are increasingly seeking

to work with (and may be willing to pay a premium for) companies that

demonstrate a commitment to ESG issues from an operational perspective. A

company may also position itself as a preferred employer, especially for the

new generation of employees who prefer to work with companies with values,

putting the environment and social issues forefront. Regulation and rating

agencies have also emphasized corporate responsibility and ESG from a risk and

governance perspective.

Whereas ESG can bring a competitive advantage amongst diverse

stakeholders, it is centered on the quality of leadership. It requires support

and accountability from the top leadership and those charged with governance as

a prerequisite for success. They need to develop a strategy to deliver on ESG

programs.

7 steps to develop and implement ESG

Strategy

The starting point for ESG is assessing materiality, then

baseline – knowing where the organisation is regarding key ESG metrics. It

requires an honest assessment of the ESG landscape in the organisation. The big

question will then be: Where does the board want the company to be and what

incremental steps should it take? This future-state response will result in

short- and long-term goals with key accountability checkpoints along the way.

The board will set the strategic objectives, incorporating these, but the

management will provide a tactical role, taking short-term incremental steps to

take the organisation to where it needs to be, as they remain accountable to

the board.

The board culture and composition have a key bearing on

the success of the sustainability journey. A diverse board improves the

dynamics of the organization by offering different perspectives, which may make

problem-solving easier and can generate innovative ideas and solutions. To maintain

an independent and engaged board, best practice includes having clearly defined

roles and expectations of board members. Members need to be evaluated for

conflict of interest and the board chair needs to be rotated regularly.

Regarding ESG, board members may consider asking the right

questions to make an impact on the ESG strategy. What are we doing to be a good

company and how are we getting better? What are you doing to take care of the environment,

our customers and other stakeholders? How does ESG fit into our organisational

structure? By viewing ESG as a strategic objective, leaders can build a common

language around the company’s values and understanding of what the company

wants to achieve and how each person fits into the larger picture.

When a company and its board are committed to ESG, they

are upholding their responsibility to evolving stakeholder priorities. Leading

by example helps to maintain a good reputation and can increase long-term

profitability and brand loyalty.

However, challenges can and should be expected along the way. The

differentiating factor that will impact an organization’s success and growth is

the organization’s response. In a workplace, there may be four different

generations with very different values working on the same team. Remaining

transparent and setting clear expectations, as well as checking in through

every step, may help ease employees through any transitions.

It can also be difficult to carve out time to focus on

priorities that may not immediately impact the bottom line and could cost money

up front, that are for the greater good of the company, the environment and the

community. However, every little bit counts, and measuring and tracking your

progress is a must. Organizational change can be measured and shared

quantitatively through financial reports, ratios, and ratings. It can be

measured qualitatively through engagement via surveys and town hall meetings.

When employees feel heard, they are more satisfied with their work. When they

and other stakeholders understand the values of the company, they are more

likely to get behind them.

No matter how big or small your goals are when it comes to

ESG, a thorough self-assessment is always the first step. Once that is

complete, it’s important to consider the state of your current board, set goals

for the organization, explore areas of opportunity and maintain transparency

every step of the way. Though it may be challenging, a company with an ESG

strategy that reflects modern times reassures shareholders, invites coveted

talent, and upholds social responsibility for the betterment of everyone.